SouthPoint Budget City Simulation provided by SouthPoint

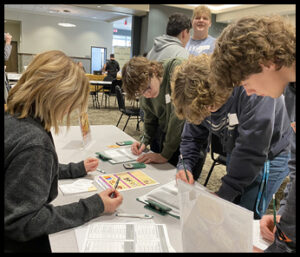

We know adulting can be hard especially when it comes to financial matters. That’s why we feel it is crucial to teach students how to build a budget and manage their money at a young age. The hands-on simulation, SouthPoint Budget City, gives students age 15-18 a taste of the real world complete with occupation, salary, spouse, student loan debt, credit card debt and medical insurance payments. The students take on the role as an adult as they navigate SouthPoint Budget City and distinguish the difference between wants and needs.

Check out the video below to get an idea of what a session of SouthPoint Budget City (fka Mad City Money) is.

Tip Sheet

Are you interested in bringing the SouthPoint Budget City program to your school or organization? We make it look easy, but a lot of details go into making it happen.

Here’s what you need to know about hosting a SouthPoint Budget City event.

About the Event

You’re a high-school student who has just been transported into the future with your friends. Some of you have just graduated from college or technical school. Some of you are married. All of you already have kids. You’ve just started your first full-time, professional job. You’re earning money and have bills to pay. Now you have to make lots of choices to provide for your family. Oh, and you need to build a budget based on your income and debt. Welcome to SouthPoint Budget City!

Request an Event

SouthPoint Budget City is available for private coordination for schools, groups, business and community organizations. There is no cost for this program. This program is currently only available in the 30 counties SouthPoint Financial Credit Union serves in Minnesota.